tax exempt blanket certificate ohio

The contractor may use a blanket exemption certificate which covers all purchases from that vendor unless specified otherwise or a unit exemption certificate which only covers a single purchase. Download the appropriate certificate below Fill out the Sales and Use.

Gaming Computers Gaming Computers Opensea

If you have tax exempt status please.

. Ohio university purchasers name po box 640 street address athens. You can use the Blanket Exemption Certificate to make. Georgia adoption petition 2018 2019 form.

Consolidated Plastics only collects sales tax for items shipped to certain states. 100 forms per pad. Find The BestTemplates at champion.

Purchaser must state a valid reason for claiming exception or exemption. Blanket Tax Exemption Form. Msa115 form 2018 2019.

Fill has a huge library of thousands of forms all set up to be filled in easily and signed. Ohio Blanket Exemption Certificate Details. Vendors name and certifi or both as shown hereon.

Check the box for a single purchase and enter the invoice number. This form is updated annually and includes the most recent changes to the tax code. Use the yellow DOWNLOAD button to access the exemption form.

Vendors name and certifies that the claim is based upon the purchasers proposed use of the items or services the activity of the purchase or. Ad STF OH41575F More Fillable Forms Register and Subscribe Now. Customer Reviews 0 769A3 - Ohio Blanket Certificate Of Exemption Revised 2014 Size.

For other Ohio sales tax exemption certificates go here. Fill out the Ohio sales tax exemption certificate form. Sections 16 are required information.

Obtain an Ohio Vendors License. Get more for ohio tax exempt form 2021. Therefore you can complete the Ohio sales tax exemption certificate form by providing your Sales Tax Number.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Ohio sales tax. 108 Bricker Hall 190 North Oval Mall Columbus Ohio 43210. Sales and Use Tax Blanket Exemption Certificate.

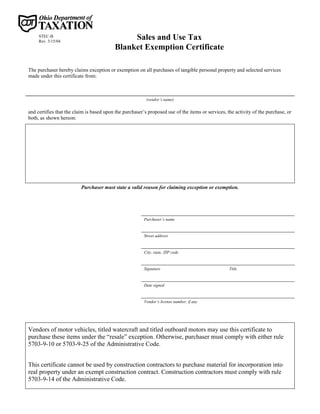

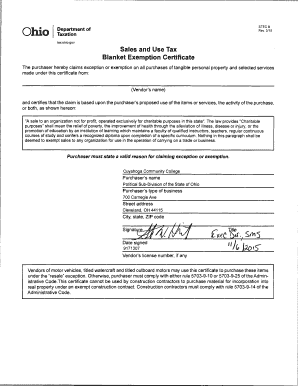

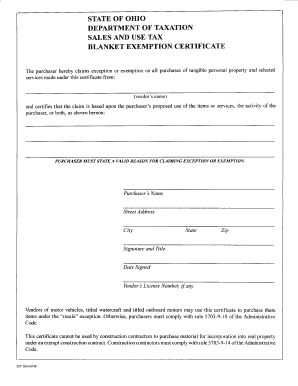

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from. The Ohio Sales Tax Exemption Form is a helpful resource that breaks down the exemptions by category. A new certificate does not need to be made for each transaction.

Sales and Use Tax. Sales and Use Tax Blanket Exemption Certificate. Office of Business and Finance.

View unit pages for individual locations Admin. Or a Sales and Use Tax Blanket Exemption Certificate form STEP B. This certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract.

This certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract. Sales taxes can be complex and trying to understand the exemptions can be daunting. Download Or Email STEC B More Fillable Forms Register and Subscribe Now.

If the box is not checked this certificate is considered a blanket certificate and remains effective until cancelled by the purchaser if purchases are no more than 12 months apart unless a longer period is allowed by. Sales and Use Tax Blanket Exemption Certificate. Ohio does permit the use of a blanket resale certificate which means a single certificate on file with the vendor can be re-used for all exempt purchases made from that vendor.

Sales and Use Tax Blanket Exemption Certificate. Construction contractors must comply with rule 5703-9-14 of the Administrative Code. Once you have that you are eligible to issue a resale certificate.

Vendors name and certifi or both as shown hereon. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from. Ohio Sales Tax Exemption Certificate.

2 Get a resale certificate fast. Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions. Step 2 Enter the vendors name.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. This form exempts ODOT from sales and use tax under Ohio Revised Code Section 573902 B-1. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from.

Assuming the contractor will make future taxable purchases from the supplier of materials to be incorporated. Ohio university purchases are exempt from sales tax based on the exemption found in section 573902 b 1 of the ohio revised code sales to the state or any of its political subdivisions p urchaser m ust s tate a v alid r eason for c laiming e xception or e xemption. Ad 1 Fill out a simple application.

Medical needs 2015 2019 form. Purchaser must state a valid reason for claiming exception or exemption. A signature is not required if in electronic form.

Filling out the Exemption Certificate is pretty straightforward but is critical for the seller to gather all the information. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from.

Ohio Blanket Sales Tax Exemption Certificate Free Download 2022 by noemietorp. 8 12 X 11. September 01 2020 ODOT.

Sales and Use Tax Blanket Exemption Certicate State of Ohio The Sales and Use Tax Blanket Exemption Certicate State of Ohio form is 1 page long and contains. You can download a PDF of the Ohio Blanket Exemption Certificate Form STEC-B on this page. Tax Exempt Form Ohio.

Sales and Use Tax Blanket Exemption Certificate. Construction contractors must comply with rule 5703-9-14 of the Administrative Code. STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from vendor s name and certifies that the claim is based upon the purchaser s proposed use of the items or services the.

Ohio Blanket Tax Exempt and Unit Exemption Certificates.

Vocab Txt Google Multiberts Seed 0 Step 160k At Main

Blanket Certificate Of Exemption Ohio Fill Online Printable Fillable Blank Pdffiller

1900 1950 Red Cedar Chest Vatican

Ohio Farming Blanket Exapmtion Certificate Fill Online Printable Fillable Blank Pdffiller

Standard Bus Procurement Guidelines Aptastandards Com

Beyc 693 Bored Eye Yacht Club Nft Opensea

Aboutthe Author Sidney M Levy Is An Independent

Pioneer Utah State Flag Seal Student Loan Forgiveness Power Of Attorney Form Loan Forgiveness

How To Get A Resale Certificate Tax Exemption For Amazon Fba Youtube

Blanket Certificate Of Exemption Ohio Fill Online Printable Fillable Blank Pdffiller

7 Steps To Import A Vehicle From Canada To The Us By Yourself

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

Putting All Of Her Heart Into Rugged Sports Before American Ninja Warrior Tryout Go Red For Women